Course Number: ABIO2413

When: Recorded playback is available between available March 25, 2024 – March 25, 2029.

Where: Available under “Course Content” at the bottom of this page.

Description: In this session, we discuss the essentials of bookkeeping from an accountant and key performance indicators for business SLPs. We will discuss the different types of business entities, what reports to look at to understand your financial situation, who needs to be issued 1099s, and how to pay contractors versus employees.

Who This Course Is Good For:

- Any ASHA member, CCC holder, or other professionals that are licensed or credentialed to practice speech-language pathology (SLP) or audiology or preparing to earn ASHA CEUs.

- A professional who is looking to start a business or has an established business.

Who This Course Isn’t Good For:

- Any professional that does not currently work in the field providing treatment or plans to in the near future.

- Professionals that solely are looking to work for another company or in a medical or school setting.

Presenters:

Venita Litvack, M.A, CCC-SLP (She/Her)

Venita is an Assistive Technology (AT) Consultant in south Florida. She has a passion for using AAC, AT, and literacy to support individuals with complex communication needs, autism, and other disabilities. Venita has delivered poster presentations on several topics related to AAC at ASHA and co-presented several ASHA CEU accredited courses. Venita co-authored two articles published in ASHA Leader’s online publication, as well as the Lou Knows What to Do book series published by Boys Town Press. Recently, Venita started utilizing the power of social media to empower and motivate educators across the country through the Speechie Side Up podcast, blog, Instagram account, and YouTube channel.

Rhian Dodd-Tovey (She/Her)

Rhian moved to the US from the UK in 2014. Rhian has a degree in accounting and has been running her business since 2017. It focuses on helping entrepreneurs with their accounting so that it doesn’t become a roadblock for their success. RDT has 3 employees and helps businesses all over the country and a few internationally too. Each year RDT Support helps bout 100 entrepreneurs with their bookkeeping and completes over 300 tax returns! Outside of work, Rhian likes to keep fit and healthy. She has an 8-year-old daughter.

Disclosure Statements

Venita Litvack has the following relevant financial relationships to disclose: ownership interest in Speechie Side Up, LLC and Tassel Learning, LLC; royalties from the Lou Knows What to Do book series.

Venita Litvack has the following relevant nonfinancial relationships to disclose: member of the ASHA Special Interest Group 12.

Rhian Dodd-Tovey has the following relevant financial relationships to disclose: RDT Support LLC and RDT Angels LLC. Affiliate of Gusto payroll provider.

Rhian Dodd-Tovey has the following nonfinancial relationships to disclose: Rhian is a registered IRS Tax Preparer.

Learning Outcomes

As a result of this activity, participants will:

- Describe at least 3 types of business entities

- Identify who needs to send or receive a 1099

- List 3 key performance indicators

- Describe 2 ways to pay contractors or employees

Agenda

| 5 min | Introductions and Backgrounds |

| 10 min | Types of business entities |

| 15 min | Who sends or receives 1099s |

| 15 min | Performance indicators |

| 10 min | How to pay contractors verse employees |

| 5 min | Closing, Discussion, and Questions |

Complaint Policy

To file a complaint or ask general questions about the complaint filing process, please contact our support team at info@tasseltogether.com

Refund Policy

Click here to read more about our refund policy.

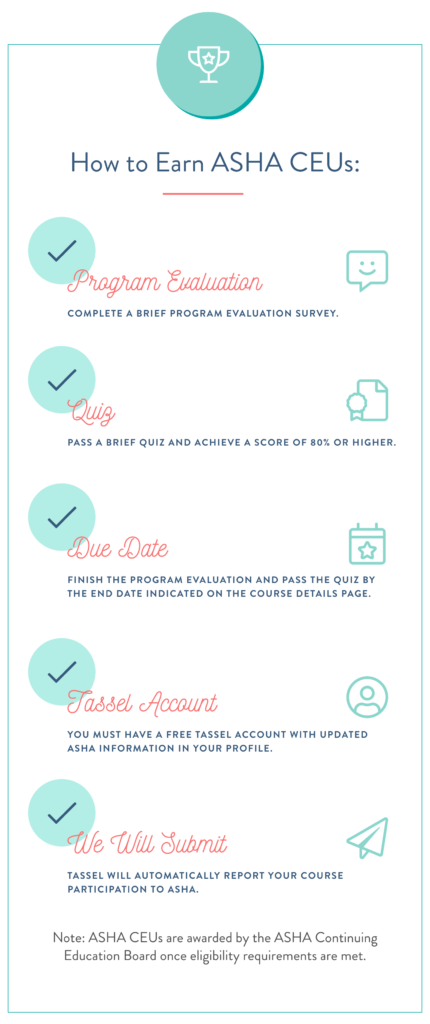

Requirements

Course Content